Are Covered Call ETFs a Scam? Part 1 - XYLD

Studying Long-Term S&P 500 and XYLD Returns

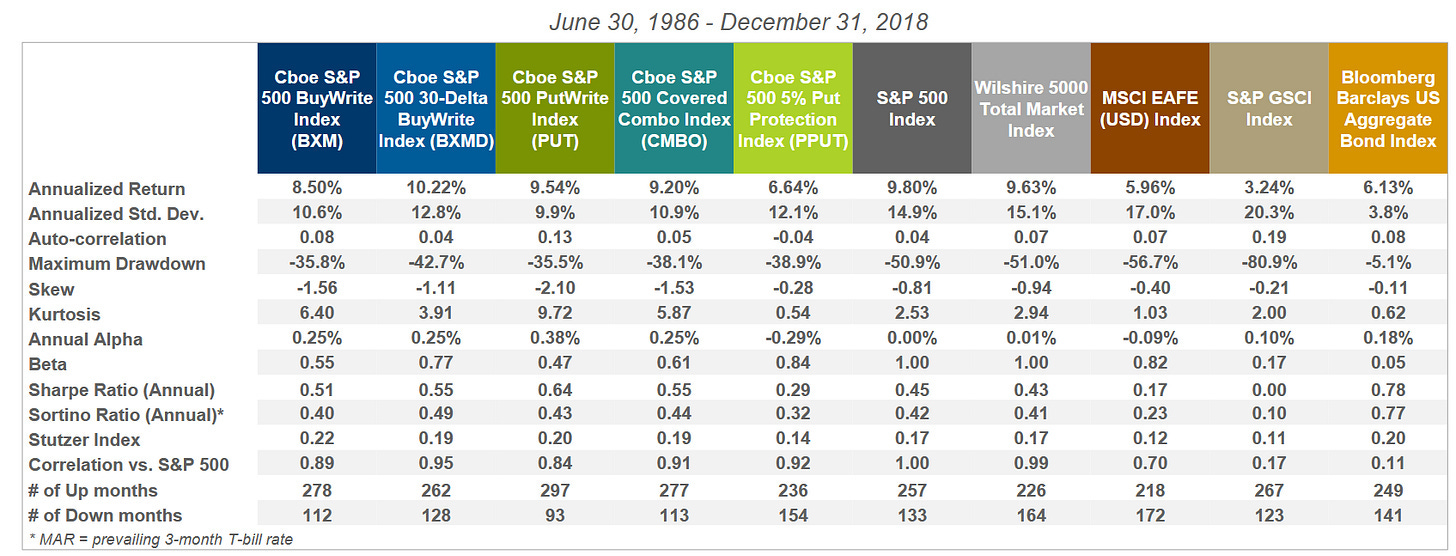

The Global X S&P 500 Covered Call ETF (XYLD) lures investors with juicy monthly dividends and a promise of stability amid market turbulence. But when some folks on X call these ETFs “scams” due to capped returns or overhyped promises, should you buy into the skepticism? By selling call options on the S&P 500, XYLD generates steady income, but is it right for you? In this article, I break down the pros and cons of this strategy, compare 30 years of data between the CBOE S&P 500 BuyWrite Index (BXM) and the S&P 500, and explain why I’ve allocated a small slice of my portfolio to XYLD. Spoiler: it’s not a scam, but it’s no golden ticket to the moon either.

I. The Theoretical Features of Covered Call ETFs: More Income, Less Volatility, Less Capital Growth

A. Covered Call for Dummies

A covered call fund like XYLD buys stocks (e.g., those in the S&P 500) and sells call options on them to earn a payment called a premium. Selling a call means signing a contract that gives the buyer the right to purchase those stocks at a set price (the strike price) before a specific date (the expiration). The fund pockets the premium right away, and this cash is added to the income distributed to investors as regular dividends. If the stock stays below the strike price at expiration, the fund keeps both the stocks and the premium; if the stock exceeds the strike price, the fund must sell the stocks to the buyer at the agreed price. XYLD sells calls on the S&P 500 index.

Access the Full Data Analysis and Investment Takeaway

The full data comparison, charts, and final investment decision are now hosted on our dedicated platform.

You have the theoretical framework, but to decide if XYLD is right for your income portfolio, you need the hard data:

The Reality Check: An analysis of 30 years of data showing where the BXM underperforms the S&P 500.

The Drawdown Risk: Charts proving why XYLD’s drawdowns were paradoxically larger than the S&P 500’s in some instances.

My Investment Take: See my personal allocation and the final verdict on who this 11.5% yield is truly for.

Click the button below to access the full archive, read the complete data analysis, and join the Pipart Global Income revolution!

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.