Are Petrobras investors all dumb ? Part 2

The brave buy Petrobras

Petrobras is a high-stakes investment, offering generous dividends alongside significant risks. In Part 1, published on June 3, 2025, on Pipart Global Income, we examined Petrobras’ structural challenges, which temper its alluring 15–16% dividend yield. State ownership—holding 50.26% of voting rights and a golden share—exposes the company to political interference, such as delayed fuel price adjustments and governance issues. Currency risk (70% of revenues in reais versus 70% of debt in dollars) and substantial debt ($59.1 billion, or 64.7% of revenues) heighten uncertainty. Geopolitical dependencies (notably on China and the U.S.), environmental fines, the fallout from Lava Jato—Brazil’s massive corruption scandal—and ESG pressures further complicate the outlook. Yet, can Petrobras’ strengths, like its attractive valuation and technological prowess, outweigh these risks? In Part 2, we explore the opportunities this controversial company presents.

I. In June 2025, Petrobras Remains a Major Player with Strong Technical Expertise

A. A Robust Industrial and Financial Position

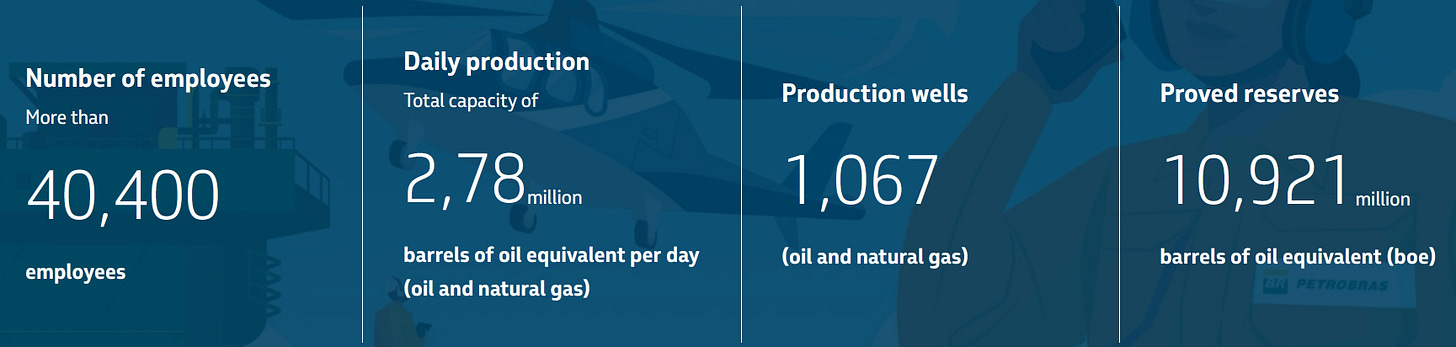

Petrobras may not be classified as a traditional oil major—likely due to its state-owned status—but it ranks among the world’s top producers, pumping 2.78 million barrels per day, or roughly 3% of global production.

Source : Petrobras

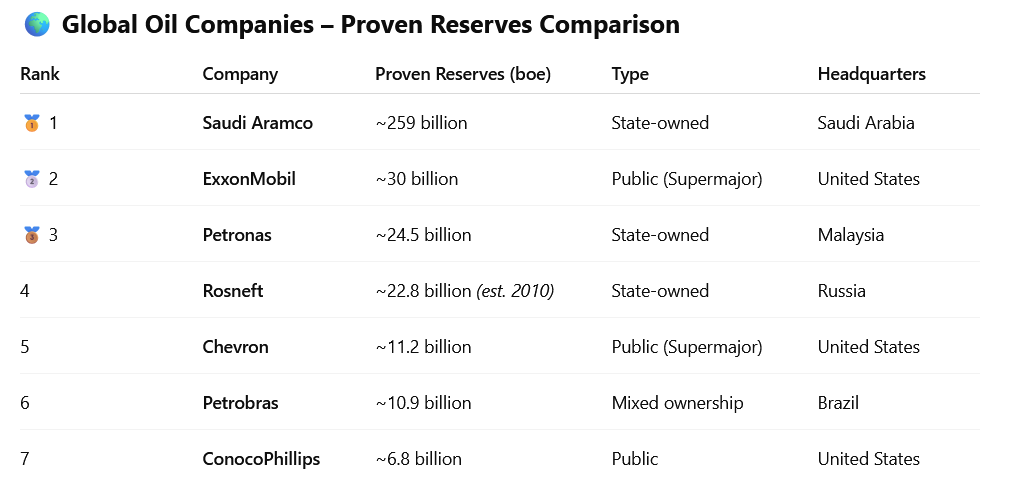

Its proven reserves of 10.921 billion barrels place it in the global top 10 among oil companies.

Access the Full Analysis and Final Investment Verdict

The full analysis, including Petrobras’s technological edge, the long-term oil market outlook, and my personal investment decision, is now hosted on our dedicated platform.

You have the technological power and the strategic focus, but to know if the double-digit yield is worth the risk, you need the complete picture:

Low-Carbon Transition: How Petrobras’s $16.3 billion investment in low-carbon initiatives compares to its global peers.

Oil’s Enduring Relevance: The critical data from the IEA’s World Energy Outlook 2024 and how AI and automation are fueling long-term energy demand.

The Final Verdict: Why I believe Petrobras investors aren’t dumb—they’re brave, and the details of my 1,770 PBR.A preferred shares purchase.

Click the button below to access the full archive, read the complete analysis, and join the Pipart Global Income revolution!

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.