Banco do Brasil Part 2 – A 10%+ Yield Proxy for Brazil’s Long-Term Growth?

Part 2 – Business and Investor Risks

Source: Banco do Brasil

As Brazil’s banking giant and a leader in agribusiness, Banco do Brasil (BBAS3, BDORY) stands out as a high-yield proxy and a bet on Brazil’s économy (cf. part 1). However, challenges like rising defaults, fintech competition, state control, and Brazil’s macroeconomic headwinds raise questions about its sustainability. How can Banco do Brasil maintain its appeal and exceptional yield amid growing risks to its core business and broader economic threats, and what does this mean for investors? To address this, we’ll first analyze the risks inherent to bank’s business model and operating environment. Then, we’ll evaluate the risks and opportunities for investors, focusing on valuation and dividend sustainability (see below the chart).

I. Business Risks: structural and cyclical threats to Banco do Brasil’s Model and Operating Environment

A. Internal Financial and Operational Vulnerabilities

1. Rising Defaults: A Burden on Margins

Banco do Brasil (BBAS3) recorded a default rate of 3.9% in Q1 2025, a rise that contributed to a significant 21% drop in its net profit, largely due to increased provisions for loan losses. This escalation in defaults, particularly in the agribusiness sector, directly pressures the bank's net profitability and necessitates higher reserves for doubtful loans. Despite this, Banco do Brasil's robust 184.8% coverage ratio and its resilient, diversified portfolio—including stable payroll-deductible loans alongside agribusiness credits—offer a buffer. However, continued growth in non-performing loans presents a short-term risk to the bank's income resilience.

2. The Digital Transformation Challenge Amid Fintech Competition

Fintechs such as Nubank, boasting 40 million clients, and Banco Inter are actively eroding the market share of traditional players like Banco do Brasil (BBAS3) by attracting younger demographics with their superior mobile services and enhanced user experiences. This competitive pressure, particularly notable as BBAS3 holds 19.6% of the payroll loan market, is leading to margin erosion for established banks due to fintechs' lower digital operating costs and challenging BB's capacity to acquire new client segments.

In response, Banco do Brasil is strategically investing over BRL 1.8 billion in technology during Q1 2025, focusing on AI and cloud to modernize its services and strengthen its mobile application. This initiative aims to leverage its vast 70-million client base, targeting 17 million 'digitally mature' users by 2025. Furthermore, BB's proactive deployment of Pix and its involvement in the Drex project highlight its leadership in payment technology. Despite fierce fintech competition, BB's significant investment capacity and established brand offer a unique opportunity to maintain its dominant position in the Brazilian digital financial ecosystem, by synergizing innovation with enduring trust.

B. Risks Tied to Brazil’s economic cycle and Environment

1. Structural Weaknesses of the Brazilian State and Agricultural Sector

Government Influence and Its Impact on Profitability

With 50.7% of its shares held by the Brazilian state (see Part 1), Banco do Brasil is exposed to politically influenced decisions that may erode long-term profitability. Government directives, such as interest rate caps on loans or mandates for social lending programs, often prioritize public policy over shareholder value, reducing net interest margins. For instance, in 2022, state-driven credit programs for small businesses forced BB to offer below-market rates, squeezing margins by 0.5%. Political appointments to the board can further align strategic decisions with electoral goals rather than financial efficiency. While state backing provides stability in crises, this influence risks inconsistent returns for investors. Agribusiness

Exposure and Vulnerability to External Shocks

With 52.1% of BB’s loan portfolio concentrated in agribusiness, the bank is highly vulnerable to climate shocks and commodity price volatility. In 2023, agricultural loan defaults rose by 10%, driven by prolonged droughts in Brazil’s Midwest and falling prices for soybeans and beef, which hit farmers’ repayment capacity. Extreme weather events, like the 2024 floods in Rio Grande do Sul, further strained borrowers, increasing provisions for loan losses. Volatility in global commodity markets, such as a 15% drop in soybean prices in 2024, exacerbates risks to BB’s portfolio. Despite strong agricultural exports (+20% to China in 2024), these factors threaten BB’s profitability and dividend stability.

2. Macroeconomic Pressures: High Rates and Slowing Growth

Brazil’s benchmark interest rate, the Selic, currently sits at 15%—a two-decade high. While this monetary tightening helps anchor inflation, it also weighs heavily on credit demand, with Banco do Brasil reporting a -5% contraction in loan growth in Q1 2025. At the same time, high rates are compressing the bank’s net interest margin, which fell to 3.2%, reflecting the cost of funding and reduced lending appetite. With GDP growth projected around 2% for 2025, the broader economic outlook remains tepid, raising concerns over rising default risks, particularly in agribusiness (3.27% default rate in Q1 2025) and consumer loans.

Source : Globalrates.com

Looking ahead, a potential interest rate cut in 2026 (to 12–13%) could offer relief—stimulating lending while gradually restoring profitability. Historically, BB’s loan performance has shown strong correlations with GDP cycles, suggesting that macro dynamics will play a crucial role in shaping the bank’s credit quality and earnings. Still, there are silver linings: elevated rates temporarily boost returns on fixed-income securities and treasury bonds, and BB’s sheer size and diversified loan portfolio give it resilience across economic cycles—mitigating the impact of slower growth.

Historically, over the past 30 years, increases in interest rates have had a mixed impact on Banco do Brasil’s dividends. On the one hand, higher rates tend to boost the bank’s net interest margins and increase income from government securities, which can support earnings and dividend payments. This has been particularly true during periods of monetary tightening when the broader economy remained relatively stable. On the other hand, when interest rate hikes trigger economic slowdowns, the resulting rise in loan defaults and provisioning costs can reduce profitability and, in turn, limit dividend payouts. Historical data shows that Banco do Brasil has benefited from higher rates in certain cycles — notably between 2010 and 2014 and again in 2022–2023 — with record dividends during times of elevated Selic rates. However, the relationship is not linear: the broader macroeconomic context plays a crucial role in determining whether rising rates translate into higher dividends.

II. Risks and Opportunities from an investor’s perspective: Valuation, Yield, and Strategies

A. Dividend Sustainability and Valuation Questions

1. Dividend Policy: Attractive but Under Scrutiny

With a 50% payout ratio, Banco do Brasil currently offers a dividend yield of 10%, well above peers like Itaú (6.5%) and Bradesco (7.2%). Since 2019, Banco do Brasil has maintained a stable payout range of 45–50%, reflecting a consistent shareholder return policy. However, the yield is sensitive to earnings: a 20% drop in profits could reduce the yield to approximately 8.5%, assuming the share price and payout ratio remain unchanged. Compared to BB Seguridade (BBSE3), which boasts an 80% payout and a 10.2% yield, BBAS3 offers a strong balance between profitability and reinvestment capacity. Its dominant position in the Brazilian banking sector, coupled with a track record of reliable distributions, supports the view that dividends will remain relatively resilient even in a softer macroeconomic environment. For long-term investors, reinvesting these high-yield dividends can significantly enhance compounded returns over time.

2. Persistent Undervaluation: Opportunity or Trap?

With a P/E ratio of 4.96 and a P/B ratio of 0.81, Banco do Brasil is trading well below its historical averages (6.6 and 1.2, respectively), reflecting persistent market pessimism. This discount contributes to increased share price volatility and limits the potential for capital appreciation, raising the risk of a value trap if macroeconomic conditions fail to improve. On the other hand, a shift in market sentiment could lead to significant revaluation. For instance, a return to a P/E of 6.0 would imply a target price of BRL 28 — a 26% upside from current levels.

Compared to major international banks like HSBC and Santander, which trade at an average P/E of around 8.0, BBAS3 appears structurally undervalued. European banks, such as BNP Paribas and Deutsche Bank, typically trade at P/E ratios of 7–8, reflecting stable but low-growth economies, while U.S. banks like JPMorgan and Bank of America command higher P/E ratios of 10–12, driven by stronger growth prospects. While investor sentiment remains cautious, the current valuation presents an attractive entry point for long-term, dividend-focused investors, provided the macro backdrop stabilizes.

B. Investment Strategies and Risk Management for income investors

1. Managing Currency Risk and Real Volatility

The Brazilian real, trading around 5.50 BRL/USD in July 2025, remains highly sensitive to geopolitical shifts and capital flows — and that volatility directly impacts foreign investor returns. A 20% depreciation of the real, for instance, could erase up to 10% of USD-denominated returns, even if BBAS3’s stock price holds steady in local currency. This isn't theoretical: the real lost 15% against the dollar in 2022 alone. For global investors, currency risk is real — and demands active management.

Banco do Brasil’s debt structure highlights both resilience and exposure. As of June 2023, roughly 80% of the bank’s funding is denominated in Brazilian reais, but it also holds about USD 1.76 billion in perpetual bonds (6.25%) and USD 1.29 billion in subordinated notes — totaling USD 3.05 billion in foreign currency debt. These instruments account for a significant share of its regulatory capital (R$39.4 billion in consolidated Tier I and II). A sharp BRL depreciation — say, over 20% — would raise the effective interest burden in local currency and put pressure on capital coverage ratios, particularly during periods of macro instability.

2. A modest international presence

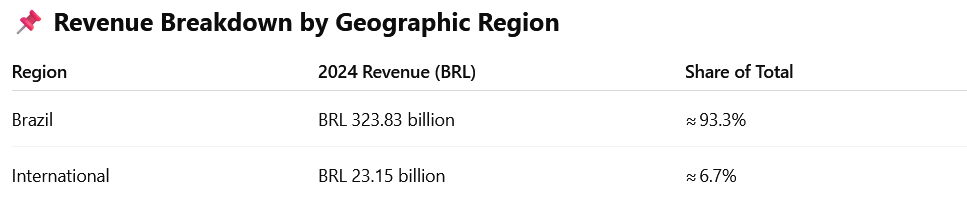

Banco do Brasil’s international operations remain modest and structurally limited in scope, despite recent growth. The bank operates just over 44 units across the U.S., Europe, Asia, and Latin America — a footprint that pales in comparison to global banking peers. In 2024, its international business generated R$1.3 billion in net profit (up 87% year-over-year), and the overseas loan portfolio expanded by 29% to R$65 billion. Yet, these operations still account for less than 10% of total revenues, underscoring their marginal weight in the bank’s overall performance.

BB’s cautious expansion strategy now targets 14 additional countries, with selective focus on Southeast Asia and Africa. However, international activities remain narrowly focused on trade finance, remittances, and sustainability-linked projects, often developed in partnership with multilateral institutions. Funding for these ventures increasingly relies on USD and EUR-denominated debt, introducing greater currency risk — without the scale or depth to meaningfully hedge or dilute domestic exposure. Ultimately, Banco do Brasil's global presence is far from being a strategic growth engine; it remains a limited adjunct to its overwhelmingly domestic business model.

Conclusion – Investment takeaway

Banco do Brasil offers an exceptional 10% dividend yield — but not without risk. Rising default rates, aggressive fintech competition, political interference, and macroeconomic headwinds all weigh on profitability and capital appreciation. For investors, this creates a double-edged situation: persistent undervaluation offers long-term upside, but also exposes them to real volatility and cyclical pressure.

Still, Banco do Brasil isn’t just another value trap. Its core strengths — dominant position in agribusiness, a 70-million strong client base, consistent payout policy, and partial state backing — provide resilience. Add to this a growing digital footprint (Pix, Drex, cloud investment) and a renewed push for operational efficiency, and BBAS3 starts to look more like a high-yield cornerstone of Brazil’s financial system than a fading legacy bank.

In short, investing in BBAS3 is a bet on Brazil’s long-term growth and Banco do Brasil’s ability to adapt. For yield-hungry investors willing to accept above-average risk, the reward may be worth the volatility.

And yes — if I’m bold enough to hold Petrobras, Banco do Brasil might just be my more rational high-yield companion.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.