Investing in One Country Could Sink Your Portfolio – Part 2

My I-CASH Method for Global High Income

Are you tired of seeing your investment portfolio buffeted by geopolitical storms or unpredictable currency swings? In Part 1, we dissected the inherent dangers of an undiversified portfolio, revealing how even seemingly safe havens can crumble under global pressures. The path to resilience is clear: global diversification. But how do you actually put it into practice?

In Part 2, we dive into the actionable steps of the I-CASH method—my proven framework for constructing a robust, income-generating portfolio. This strategy guides you through International Diversification (I), targeting varied markets; Currency Diversification (C), focusing on undervalued currencies; Asset Class (A), choosing optimal income-generating assets; Sector Diversification (S), spreading across industries; and finally, High Yield (H), prioritizing strong returns. Let's unlock the secrets to building a truly resilient income portfolio.

I. The I-CASH Method: Your Blueprint for Consistent Income

No investment approach is flawless, but a clear framework is your most potent defense against market noise and impulsive decisions. It guards against chasing fleeting trends and helps you stay level-headed during sudden market swings. The I-CASH method, which I’ve refined over years, offers a consistent, structured way to reinvest dividends each month, systematically deciding which market, currency, asset, sector, and yield level to target.

The acronym I-CASH isn't just a mnemonic; each letter represents a crucial reinvestment principle designed to manage portfolio concentration and maximize income:

I (International Diversification): Directs where we allocate capital across countries.

C (Currency Diversification): Emphasizes selecting currencies that offer an edge.

A (Asset Class): Focuses exclusively on income-generating assets. Our choices span stocks, preferred shares, bonds, listed real estate (REITs), and crucially, covered call ETFs, which we treat as a distinct asset class for their specific income profile.

S (Sector Diversification): Follows the widely recognized 11 GICS (Global Industry Classification Standard) sectors. Sectors with naturally higher dividend payouts will, of course, receive a greater weighting in our income-driven approach.

H (High Yield): This is our gatekeeper. Yields below a strict 9-10% threshold simply don't qualify for consideration.

II. I for International Diversification: Spreading Your Wings

A. Principles and Tools

Our core objective here is to spread portfolio investments across all continents and various markets. The most direct and often most effective way to achieve this for high income is by investing in local stock exchanges, actively seeking out stocks with significant income potential.

Some might argue that simply buying an MSCI World ETF is less effort. True, it offers broad diversification with minimal fuss. However, our aim isn't just broad exposure; it's high income. Direct investment allows us to pinpoint undervalued, high-yielding opportunities that broad ETFs might dilute or overlook entirely.

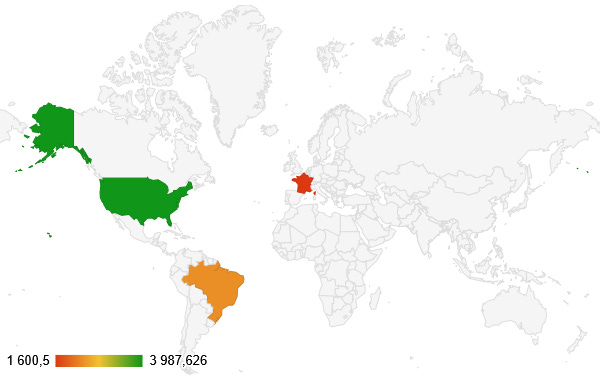

The tool for this step is straightforward: a world map that visually plots your portfolio’s investments. This immediate visual feedback clearly shows where you're overexposed and where untapped opportunities lie.

B. Case Study: My Portfolio's Global Footprint

Let's apply this to my personal portfolio, currently valued at just under $80,000 and generating over $9,000 annually. I've completely rebuilt it between February and early June 2025. With $400 in fresh dividends ready for reinvestment, it's time to put the I-CASH method into action.

A quick glance at my world map reveals a significant cluster in the U.S., Brazil, and France. This immediately flags a clear priority: diversification into regions like Asia or other parts of Europe is essential to de-risk and unlock new income streams. The analysis, at this point, couldn't be simpler.

Access the Full Analysis and Final Investment Selection

We have identified two top targets for diversification: Japan and Brazil. The next steps—optimizing for Asset Class (A), balancing Sector Diversification (S), and finding the final High Yield (H) candidate—are the most critical.

In the remainder of the analysis, we reveal the final selection for this reinvestment—a stock yielding over 10%—and explain the precise asset class and sector trade-offs that led to the decision.

You are missing the actionable final conclusion of the I-CASH method:

The Asset Class Rebalancing needed to move away from overrepresented Covered Call ETFs.

The Sector Diversification required to expand beyond Energy, IT, and Real Estate.

The Final Stock Selection: The exact Brazilian stock yielding over 10% that meets all I-CASH criteria.

Click the button below to access the full archive, read the complete analysis, and see the final investment selection on our platform:

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Keeping all your investments in one country feels easier because you know the rules and the system. But one election, one policy change, or one currency swing can flip the whole game on you.