Who Really Are the Income Investors?

The Psychology, Demographics, and Global Rise of Dividend Seekers

They’re older. They’re everywhere. And they’re quietly moving trillions.

In 2025, one ETF — JPMorgan’s JEPI — crossed $41 billion in assets. Its sibling JEPQ hit $29 billion. In China, dividend funds pulled in the equivalent of $6 billion in a single year. From New York to Tokyo, money is flowing into products that promise one thing: regular cash in your pocket.

Now picture this: a 68-year-old retiree, coffee in hand, watching dividends drop into his account every month. For him, those payments are worth more than a soaring capital curve. They’re not just income. They’re security, discipline, and peace of mind.

Every year, millions of investors make the same choice — prioritizing dividends over capital gains. This defies classical economic theory. But it’s not irrational. It’s human.

After years without doing a deep literature dive, I decided to seek both academic and market answers to a simple question: Who really are the income investors — and why do they invest this way?

I. Demographics: Growing in Number, Older, Not Necessarily Wealthier or More Educated

If you want to understand income investors, the obvious starting point is to look at who they are — and more importantly, how many they are. And here’s the thing: they’re not a niche group lurking in obscure corners of the market. They’re a growing global force, reshaping product design and capital flows.

A. Quantifying the Population: Insights from Market Data

Since there is no global register of "income investors," their presence is often inferred through market activity and product demand.

1/ The Exploding Supply of Income Products as a Key Indicator

A primary indicator of their growing numbers is the booming market for public income products. Consider the capital flows into funds like JPMorgan’s JEPI (JPMorgan Equity Premium Income ETF) and JEPQ (JPMorgan Nasdaq Equity Premium Income ETF) in the USA. JEPI reached approximately $41 billion in AUM by July 2025, and JEPQ around $29 billion. Their European UCITS equivalents, launched in late 2024, have also collected substantial sums, indicating significant international demand. Dividend funds in China (e.g., CNY 42 billion, or ~$6 billion USD, by the end of 2023, showing a steep rise) and global dividend-focused ETFs (experiencing inflows of $23.7 billion in H1 2025, the highest in 3 years) continue to gather significant assets. This widespread collection of funds confirms a massive demand for income-oriented products.

2/ Measuring the Invisible: Proxies and Surveys

Beyond market flows into income-specific products, national household surveys, taxation data, and regional investment patterns offer robust and verifiable means to quantify this elusive population, providing crucial insights into investor behavior across regions.

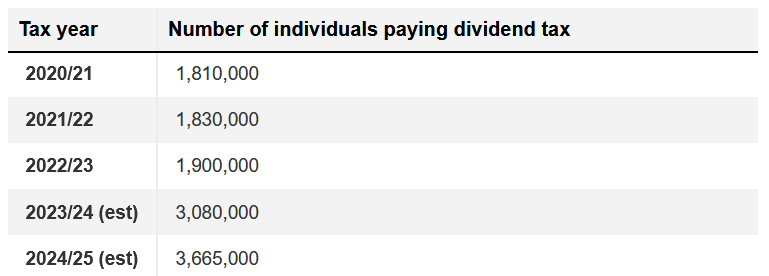

Comprehensive studies from leading financial authorities directly capture the stated objectives and investment habits of millions worldwide. For instance, reports from the Federal Reserve (US) and Vanguard's How America Saves series consistently reveal a significant segment of investors prioritizing income generation and wealth preservation over pure capital appreciation. In Europe, the FCA's Financial Lives Survey 2024 (UK) similarly describes profiles of individuals whose financial stability relies heavily on regular distributions, with the lowering of the dividend allowance in the UK in 2024/25 notably bringing a record 3.7 million people into dividend tax, signaling a massive and active base of dividend recipients.

This pattern of income-seeking behavior is also observed in Asia, particularly in markets with aging saver bases like Japan and Korea, where deep listed real estate markets (REITs) play a significant role in providing distributive products. While less precise for hard numbers, the vibrant online communities dedicated to dividend investing (e.g., popular subreddits with millions of subscribers) serve as a global qualitative indicator of this engaged audience, reflecting a widespread, expressed interest in predictable income streams. Income investors are growing in numbers, but who are they?

B. Demographic Characteristics: Older, Not Richer

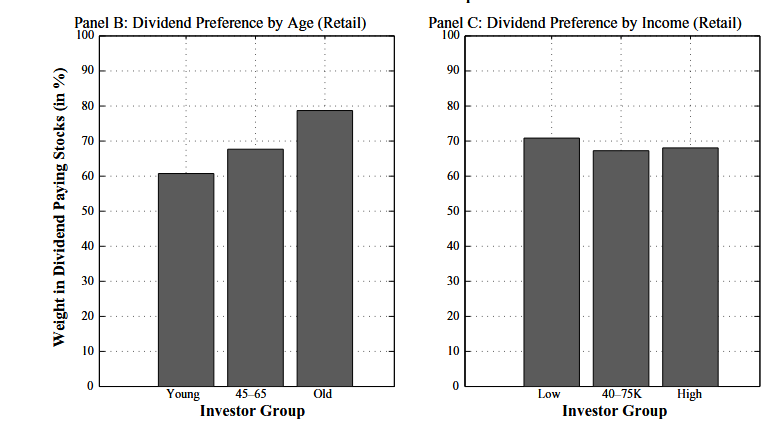

Empirical studies confirm that demographic characteristics significantly influence investors’ dividend preferences.

1/ Age and Dividend Preferences: A Clear Link

The global aging trend, with increasing proportions of individuals aged 65 and over in the US, EU, and Asia-Pacific, directly fuels the demand for income-generating investments. Older investors tend to favor dividend-paying stocks more. A study by Graham and Harvey (2001) shows that older investors allocate a larger proportion of their portfolios to high-dividend stocks. This preference is even stronger among those with lower incomes, suggesting that dividends serve as a crucial source of current income for this group. Another study by Weisbenner (2005) indicates that companies located in communities with a higher proportion of people aged 65 and over are more likely to pay dividends, highlighting the importance of local preferences among senior investors. The proportion of income investors demonstrably grows with age, retirement, and longevity uncertainty.

Source: Journal of finance - https://people.duke.edu/~jgraham/website/DivClientele_JF_Final.pdf

2/ Income & Socioeconomic Status: An Observed Divergence

A notable divergence exists when examining investment preferences across socioeconomic strata. Investors with low or moderate incomes, often driven by a greater need for regular cash flows, demonstrably show a stronger preference for dividends. Research indicates that these individuals allocate a larger portion of their portfolios to high-dividend stocks. Conversely, high-income investors or those with advanced education levels (e.g., PhD holders) tend to prioritize capital growth. For instance, a study on the Pakistan Stock Exchange specifically found that PhD holders exhibited significantly lower preferences for cash dividends compared to individuals with only a secondary education. This observed inverse relationship, highlighted in academic findings, suggests that financial security and educational background can significantly shape an investor's fundamental preference for either direct income or asset appreciation. However, such correlations are complex and often subject to specific market, psychological and cultural contexts.

3/ Gender and Marital Status (Mixed Findings)

Unlock the Full Psychological and Strategic Analysis

We’ve explored the demographics, confirming that income investors are a massive, growing force of older and typically moderate-income individuals. But this only answers who they are—it doesn’t explain why they defy economic theory.

The remainder of this deep-dive is hosted on our main platform, where we dissect the psychology and future challenges of this investor segment.

In the full article, you will discover:

The “Why”: A deep dive into the “Dividend Puzzle” and the powerful role of Mental Accounting in providing psychological comfort and discipline.

The Global Risks: Why the passive income market is nearing saturation and the main challenges (Yield Traps, Total Return Debate) that threaten your future global income.

Intellectual Takeaway: The final conclusion on how to position yourself for a rapidly aging world where the need for reliable income is set to explode.

To understand the unique mindset of the income investor and learn how to secure your financial future, click the button below to read the complete article on our website:

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. The views expressed are solely those of the author and do not constitute a recommendation to buy, sell, or hold any security. Always conduct your own research and consult with a professional before making any investment decisions.