Banco do Brasil as an income investment – short term pain was certain

Dividend is lower but I hold

My small position in Banco do Brasil (ADR – BDORY) was intended as a bet on the Brazilian economy, and more specifically on its agriculture. Short-term pain was certain. I knew it… and it happened intensely in 2025 with the agribusiness downturn. But my investment thesis hasn’t changed fundamentally, and I only hold a very small position. The stock is currently trading around the same levels as when I bought it initially (adjusted for currency), and the dividend yield has become more variable – lower in absolute terms this year due to profit pressures, but still attractive on a forward basis. Regardless, my thesis remains focused on the long-term potential, from an income investor perspective. The events of 2025 remind me that this type of investment involves significant cyclicality in income generation, which is part of the deal for high-yield emerging market banks. Still, I believe this remains the investment style best suited to me – with regular reviews of the long-term strengths and short-term realities.

I. Banco do Brasil Investment Thesis: A High-Yield, High-Risk Proxy for Brazil’s Economy

A. A Macroeconomic Play with a Double-Digit Dividend Yield Appeal

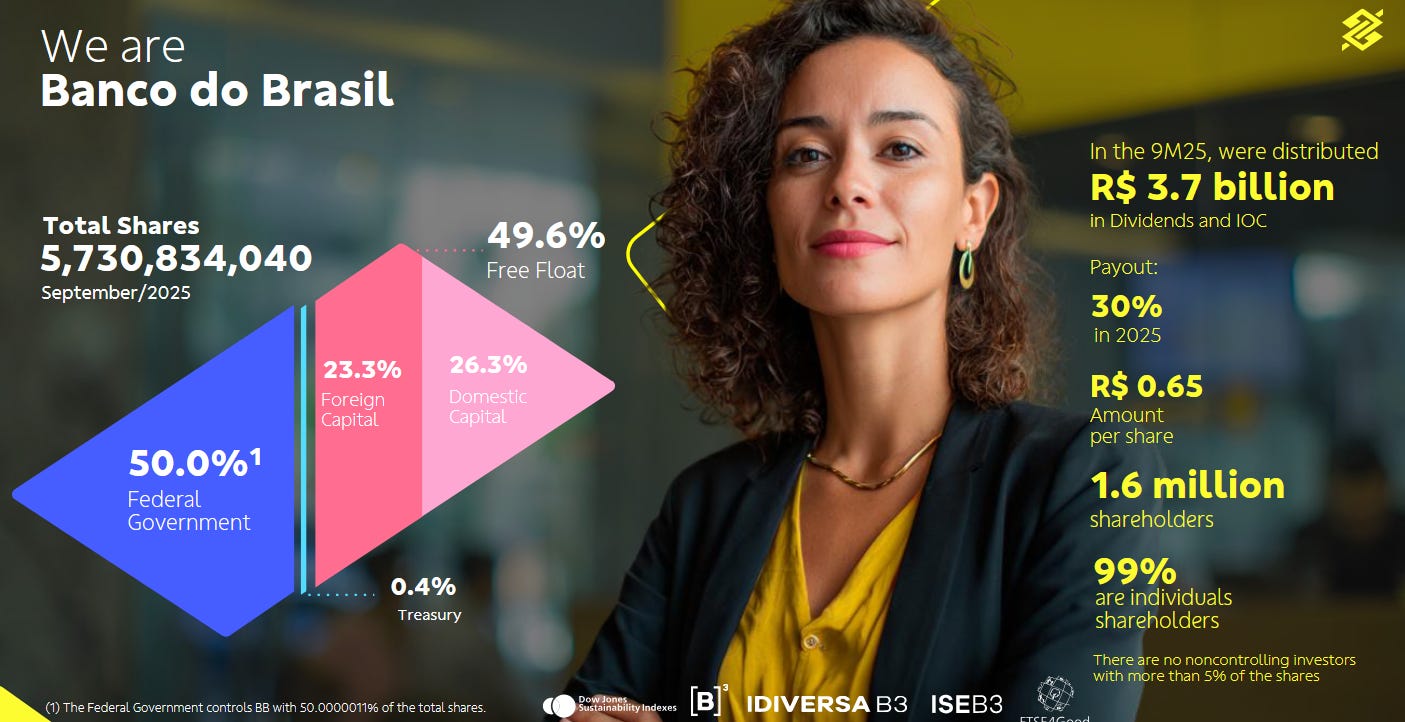

Banco do Brasil (BB) stands as a foundational pillar of the Brazilian economy, offering investors a direct channel to the nation’s long-term growth prospects. Established in 1808 and operating a network of over 4,700 branches, the bank’s 217-year history is deeply intertwined with Brazil’s development, from financing its first coffee exports to becoming the backbone of its modern agribusiness sector.

Source: Q3 Banco do Brasil Results

With 50% state ownership and a market capitalization of approximately $40 billion USD, BB functions as a key barometer for national economic health. The core investment thesis is a dual bet: on Brazil’s robust macroeconomic fundamentals and on the bank’s ability to generate and distribute substantial earnings. Brazil’s assets are compelling for long-term growth; it is a global leader in agricultural and mineral exports, possesses a young and growing population that supports a dynamic domestic market, and has demonstrated solid GDP growth of 3.4% in 2024, with projections from the World Bank and IMF pointing to a sustained convergence of 2.2%–2.5% in the coming years.

New trade agreements, such as the one with the European Union, further enhance export diversification prospects. Banco do Brasil leverages this environment directly, generating its revenue from a diversified yet Brazil-centric portfolio. In 2024, the bank reported total revenues of 102.27 billion BRL, with retail banking for individual clients contributing 35%, corporate banking 30%, and its strategic agricultural financing segment accounting for 20%. This structure makes BB a leveraged play on both domestic consumption and the global commodities cycle.

The most compelling figure for income-focused investors is the dividend yield, which currently stands at approximately 6% forward for the ADR, supported by the bank’s payout policy targeting 45–50% of earnings (with some flexibility shown in 2025 to preserve capital amid provisions). Historically, Banco do Brasil has generated double-digit dividend yields in BRL at cycle peaks; the current ~5–7% forward yield in USD for the ADR reflects both earnings pressure and Brazilian real volatility.

This policy has resulted in a track record of consistent, albeit cyclical, shareholder returns. The sustainability of this high yield is rooted in the bank’s dominant market position and its earnings power. For context, this yield significantly outpaces those offered by its main domestic peers, Itaú (6.5%) and Bradesco (7.2%), and is on par with its more focused subsidiary, BB Seguridade (BBSE3), which has a 10.2% yield but an 80% payout ratio. The performance of the stock itself has been strong; from 2016 to 2025, it outperformed the S&P 500. However, this performance comes with a significant price in the form of extreme volatility, with a standard deviation of 50.72% compared to the S&P 500’s 15.49% over the same period. This volatility is acknowledged as an inherent feature of the investment, but it is also framed as a mechanism that creates regular, attractive entry points for long-term investors.

B. Navigating a Labyrinth of Operational and Economic Risks

The pursuit of a 10% yield from a Brazilian state-owned bank is accompanied by a complex web of risks that directly challenge its profitability and dividend sustainability. A primary and immediate concern is the rising rate of loan defaults. In the first quarter of 2025, Banco do Brasil’s default rate reached 3.9%, a key factor behind a significant 21% drop in its net profit due to increased provisions for loan losses. This risk is acutely concentrated in the agribusiness sector, which constitutes 52.1% of the bank’s total loan portfolio. This heavy exposure makes BB profoundly vulnerable to external shocks; a 15% drop in soybean prices in 2024, coupled with climate disasters like the 2024 floods in Rio Grande do Sul, directly impair farmers’ repayment capacity and force the bank to set aside more capital, threatening its bottom line.

Source: Q3 Banco do Brasil Results

Simultaneously, the bank’s traditional dominance is under siege from agile digital fintechs. Nubank, with its 40 million clients in Brazil, and Banco Inter are aggressively capturing market share, particularly among younger demographics, by offering superior user experiences and lower-cost digital services. This competition erodes margins and challenges BB’s ability to grow its client base. In response, the bank is undertaking a massive digital transformation, investing over 1.8 billion BRL in technology in Q1 2025 alone, focusing on AI and cloud infrastructure to modernize its services and leverage its vast base of 70 million clients. Beyond market competition, the bank’s 50.7% state ownership introduces the persistent risk of political interference. Government directives can and have prioritized social and political goals over profitability; for example, in 2022, state-mandated credit programs for small businesses forced BB to offer below-market rates, squeezing its net interest margins by an estimated 0.5%. Political appointments to the board further risk aligning strategic decisions with electoral cycles rather than long-term shareholder value. The broader macroeconomic environment adds another layer of pressure. Brazil’s benchmark Selic interest rate, at a two-decade high of 15% as of mid-2025, suppresses credit demand—evidenced by a -5% contraction in loan growth in Q1 2025—and compresses the bank’s net interest margin, which fell to 3.2%.

C. Investor Calculus: Undervaluation, Currency Volatility, and Strategic Position

For a global investor, the decision to invest in Banco do Brasil requires a careful calculus of its compelling valuation metrics against its unique set of risks, with currency exposure being paramount. The bank remains fundamentally undervalued by traditional measures. It currently trades at a trailing Price-to-Earnings (P/E) ratio of approximately 5.5–6.5 (forward P/E around 4–5 based on normalized earnings expectations) and a Price-to-Book (P/B) ratio of about 0.9, still below its longer-term historical averages (P/E 7 and P/B ~1.0–1.2) and at a meaningful discount to international peers like HSBC (8–10) and Santander (~10), or U.S. giants like JPMorgan (14–16). This persistent discount reflects ongoing market concerns over credit quality and cyclical pressures but also presents an attractive opportunity; a moderate re-rating of the P/E to just 7.0–8.0 (closer to historical norms) could imply a target price representing 20–40% upside from current levels, depending on earnings recovery. However, this undervaluation also embodies market pessimism and carries the real risk of a prolonged “value trap” if Brazil’s macroeconomic conditions – particularly in agribusiness – fail to stabilize and improve.

The single greatest risk for a foreign investor is the volatility of the Brazilian Real (BRL), which traded around 5.50 BRL/USD in July 2025 and 5.42 today. The Real is highly sensitive to capital flows and geopolitical shifts, and a sharp depreciation can decimate USD-denominated returns. Historically, a 15% depreciation of the Real in 2022 alone demonstrated how currency moves can override strong local stock performance. This risk is compounded by the bank’s own financial structure; it holds approximately $3.05 billion in foreign currency debt, including perpetual bonds and subordinated notes. A significant depreciation of the Real, say over 20%, would increase the local currency cost of servicing this debt, putting pressure on its capital coverage ratios. While the bank is expanding internationally, with its overseas loan portfolio growing 29% to R$65 billion in 2024, these operations remain marginal, contributing less than 10% of total revenue and offering no meaningful hedge against domestic exposure.

In conclusion, Banco do Brasil represents a high-conviction, high-stakes investment. It is a strategic wager on Brazil’s long-term economic ascent, channeled through a historically resilient institution that pays an exceptional dividend yield from a position of market dominance. The current deep undervaluation offers a considerable margin of safety and potential for capital appreciation. However, this opportunity is unequivocally counterbalanced by substantial and interconnected risks: economic cyclicality, political interference, intense fintech competition, and profound currency volatility. The investor’s premise is that Banco do Brasil is not a value trap, but a high-yield cornerstone for those with the patience and risk tolerance to navigate Brazil’s dynamic and volatile landscape, understanding that the reward of a double-digit yield is the direct compensation for assuming this elevated level of risk.

II. Q3 2025 Results: A Severe but Anticipated Stress Test in a Challenging Context

The third-quarter 2025 results for Banco do Brasil served as a severe stress test that largely confirmed the high-risk, cyclical nature of the original thesis. However, the deterioration proved more intense than initially modeled, particularly in agribusiness, leading to sharper profit declines and a more conservative outlook. The stock price has since retreated from earlier highs, reflecting these pressures, but the core long-term case – as a leveraged play on Brazil’s recovery – remains intact for patient income investors.

Source: Yahoo Finance

A. The Foreseen Risks Materialize More Intensely Than Expected

1. Agricultural Concentration: The Downcycle Hits Hard

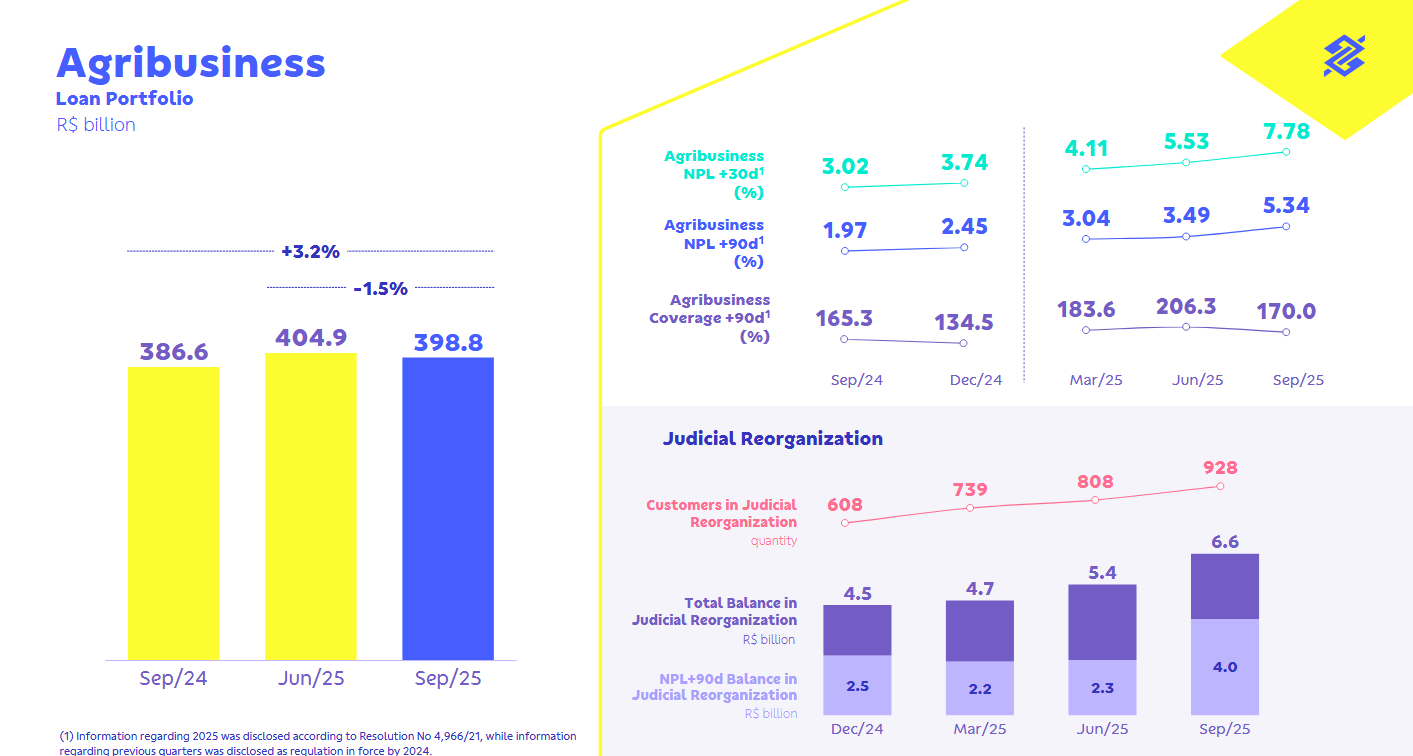

The quarter highlighted the vulnerabilities of the bank’s heavy reliance on agribusiness (still 52% of the loan book). Commodity price weakness, weather issues, and high input costs severely impacted farmer repayment ability – exactly as anticipated, but with greater severity. Agricultural NPLs (90+ days) surged to 5.34%, up from 3.49% in Q2 and a dramatic rise from 1.97% a year earlier, triggering massive provisions.

2. Credit Risk Dominates

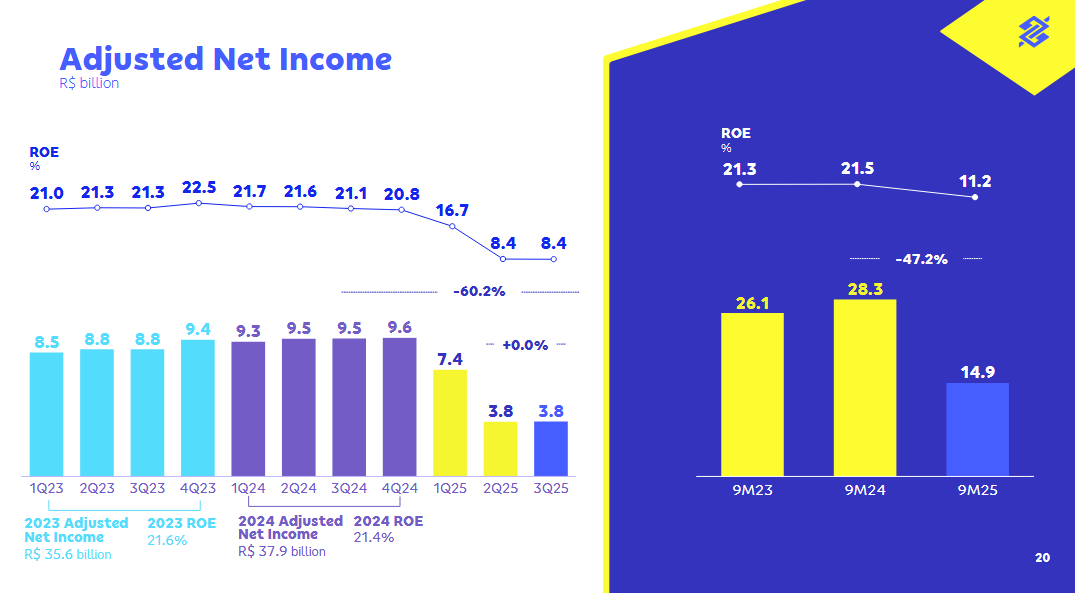

Profitability Q3 underscored how provisions can overwhelm operational resilience. While net interest income grew modestly and fees remained stable (R$8.9B), expenses were controlled – these positives were entirely offset by exploding loan loss provisions. Adjusted net income collapsed ~60% year-over-year to ~R$3.8 billion, with ROE dropping to 8.4% (from over 20% previously). This validated the thesis that credit cycles, especially in agro, drive earnings volatility far more than competition or margins.

Source: Q3 Banco do Brasil Results

B. The Updated Investment Calculus: Lower Price, Persistent Risks, but Attractive Yield

1. Extended Recovery Timeline

Management lowered 2025 guidance significantly (adjusted net income now R$18–21 billion, targeting ~R$20 billion), with the agribusiness delinquency peak potentially extending into 2026. Renegotiations (supported by government measures) are underway, but normalization is a 2026+ story. Visibility remains limited.

Source: Q3 Banco do Brasil Results

2. Dividend Sustainability and Adjusted Payout

The bank reduced its 2025 payout ratio to 30% (from the prior 40-45% range) to preserve capital amid high provisions and regulatory needs. This introduces more variability to shareholder returns, reinforcing the cyclical income profile. However, the forward dividend yield remains compelling – around ~5-7% for the ADR BDORY in USD, impacted by currency) – still well above peers, supported by the bank’s dominant position.

3. Prudent Defense in a Tough Environment

The modest contraction in the loan book reflects disciplined risk management rather than weakness. Digital investments continue, but credit resolution remains the priority. Capital ratios provide a buffer, though near-term ROE pressure persists.

My small position in Banco do Brasil (ADR – BDORY) was intended as a bet on the Brazilian economy, and more specifically on its agriculture. Short-term pain was certain. I knew it… and it happened intensely in 2025 with the agribusiness downturn. But my investment thesis hasn’t changed fundamentally, and I only hold a very small position. The stock is currently trading around the same levels as when I bought it initially (adjusted for currency), and the dividend yield has become more variable – lower in absolute terms this year due to profit pressures, but still attractive on a forward basis. Regardless, my thesis remains focused on the long-term potential, from an income investor perspective. The events of 2025 remind me that this type of investment involves significant cyclicality in income generation, which is part of the deal for high-yield emerging market banks. Still, I believe this remains the investment style best suited to me – with regular reviews of the long-term strengths and short-term realities.

I. Banco do Brasil Investment Thesis: A High-Yield, High-Risk Proxy for Brazil’s Economy

A. A Macroeconomic Play with a Double-Digit Dividend Yield Appeal

Banco do Brasil (BB) stands as a foundational pillar of the Brazilian economy, offering investors a direct channel to the nation’s long-term growth prospects. Established in 1808 and operating a network of over 4,700 branches, the bank’s 217-year history is deeply intertwined with Brazil’s development, from financing its first coffee exports to becoming the backbone of its modern agribusiness sector.

Source: Q3 Banco do Brasil Results

With 50% state ownership and a market capitalization of approximately $40 billion USD, BB functions as a key barometer for national economic health. The core investment thesis is a dual bet: on Brazil’s robust macroeconomic fundamentals and on the bank’s ability to generate and distribute substantial earnings. Brazil’s assets are compelling for long-term growth; it is a global leader in agricultural and mineral exports, possesses a young and growing population that supports a dynamic domestic market, and has demonstrated solid GDP growth of 3.4% in 2024, with projections from the World Bank and IMF pointing to a sustained convergence of 2.2%–2.5% in the coming years.

New trade agreements, such as the one with the European Union, further enhance export diversification prospects. Banco do Brasil leverages this environment directly, generating its revenue from a diversified yet Brazil-centric portfolio. In 2024, the bank reported total revenues of 102.27 billion BRL, with retail banking for individual clients contributing 35%, corporate banking 30%, and its strategic agricultural financing segment accounting for 20%. This structure makes BB a leveraged play on both domestic consumption and the global commodities cycle.

The most compelling figure for income-focused investors is the dividend yield, which currently stands at approximately 6% forward for the ADR, supported by the bank’s payout policy targeting 45–50% of earnings (with some flexibility shown in 2025 to preserve capital amid provisions). Historically, Banco do Brasil has generated double-digit dividend yields in BRL at cycle peaks; the current ~5–7% forward yield in USD for the ADR reflects both earnings pressure and Brazilian real volatility.

This policy has resulted in a track record of consistent, albeit cyclical, shareholder returns. The sustainability of this high yield is rooted in the bank’s dominant market position and its earnings power. For context, this yield significantly outpaces those offered by its main domestic peers, Itaú (6.5%) and Bradesco (7.2%), and is on par with its more focused subsidiary, BB Seguridade (BBSE3), which has a 10.2% yield but an 80% payout ratio. The performance of the stock itself has been strong; from 2016 to 2025, it outperformed the S&P 500. However, this performance comes with a significant price in the form of extreme volatility, with a standard deviation of 50.72% compared to the S&P 500’s 15.49% over the same period. This volatility is acknowledged as an inherent feature of the investment, but it is also framed as a mechanism that creates regular, attractive entry points for long-term investors.

B. Navigating a Labyrinth of Operational and Economic Risks

The pursuit of a 10% yield from a Brazilian state-owned bank is accompanied by a complex web of risks that directly challenge its profitability and dividend sustainability. A primary and immediate concern is the rising rate of loan defaults. In the first quarter of 2025, Banco do Brasil’s default rate reached 3.9%, a key factor behind a significant 21% drop in its net profit due to increased provisions for loan losses. This risk is acutely concentrated in the agribusiness sector, which constitutes 52.1% of the bank’s total loan portfolio. This heavy exposure makes BB profoundly vulnerable to external shocks; a 15% drop in soybean prices in 2024, coupled with climate disasters like the 2024 floods in Rio Grande do Sul, directly impair farmers’ repayment capacity and force the bank to set aside more capital, threatening its bottom line.

Source: Q3 Banco do Brasil Results

Simultaneously, the bank’s traditional dominance is under siege from agile digital fintechs. Nubank, with its 40 million clients in Brazil, and Banco Inter are aggressively capturing market share, particularly among younger demographics, by offering superior user experiences and lower-cost digital services. This competition erodes margins and challenges BB’s ability to grow its client base. In response, the bank is undertaking a massive digital transformation, investing over 1.8 billion BRL in technology in Q1 2025 alone, focusing on AI and cloud infrastructure to modernize its services and leverage its vast base of 70 million clients. Beyond market competition, the bank’s 50.7% state ownership introduces the persistent risk of political interference. Government directives can and have prioritized social and political goals over profitability; for example, in 2022, state-mandated credit programs for small businesses forced BB to offer below-market rates, squeezing its net interest margins by an estimated 0.5%. Political appointments to the board further risk aligning strategic decisions with electoral cycles rather than long-term shareholder value. The broader macroeconomic environment adds another layer of pressure. Brazil’s benchmark Selic interest rate, at a two-decade high of 15% as of mid-2025, suppresses credit demand—evidenced by a -5% contraction in loan growth in Q1 2025—and compresses the bank’s net interest margin, which fell to 3.2%.

C. Investor Calculus: Undervaluation, Currency Volatility, and Strategic Position

For a global investor, the decision to invest in Banco do Brasil requires a careful calculus of its compelling valuation metrics against its unique set of risks, with currency exposure being paramount. The bank remains fundamentally undervalued by traditional measures. It currently trades at a trailing Price-to-Earnings (P/E) ratio of approximately 5.5–6.5 (forward P/E around 4–5 based on normalized earnings expectations) and a Price-to-Book (P/B) ratio of about 0.9, still below its longer-term historical averages (P/E 7 and P/B ~1.0–1.2) and at a meaningful discount to international peers like HSBC (8–10) and Santander (~10), or U.S. giants like JPMorgan (14–16). This persistent discount reflects ongoing market concerns over credit quality and cyclical pressures but also presents an attractive opportunity; a moderate re-rating of the P/E to just 7.0–8.0 (closer to historical norms) could imply a target price representing 20–40% upside from current levels, depending on earnings recovery. However, this undervaluation also embodies market pessimism and carries the real risk of a prolonged “value trap” if Brazil’s macroeconomic conditions – particularly in agribusiness – fail to stabilize and improve.

The single greatest risk for a foreign investor is the volatility of the Brazilian Real (BRL), which traded around 5.50 BRL/USD in July 2025 and 5.42 today. The Real is highly sensitive to capital flows and geopolitical shifts, and a sharp depreciation can decimate USD-denominated returns. Historically, a 15% depreciation of the Real in 2022 alone demonstrated how currency moves can override strong local stock performance. This risk is compounded by the bank’s own financial structure; it holds approximately $3.05 billion in foreign currency debt, including perpetual bonds and subordinated notes. A significant depreciation of the Real, say over 20%, would increase the local currency cost of servicing this debt, putting pressure on its capital coverage ratios. While the bank is expanding internationally, with its overseas loan portfolio growing 29% to R$65 billion in 2024, these operations remain marginal, contributing less than 10% of total revenue and offering no meaningful hedge against domestic exposure.

In conclusion, Banco do Brasil represents a high-conviction, high-stakes investment. It is a strategic wager on Brazil’s long-term economic ascent, channeled through a historically resilient institution that pays an exceptional dividend yield from a position of market dominance. The current deep undervaluation offers a considerable margin of safety and potential for capital appreciation. However, this opportunity is unequivocally counterbalanced by substantial and interconnected risks: economic cyclicality, political interference, intense fintech competition, and profound currency volatility. The investor’s premise is that Banco do Brasil is not a value trap, but a high-yield cornerstone for those with the patience and risk tolerance to navigate Brazil’s dynamic and volatile landscape, understanding that the reward of a double-digit yield is the direct compensation for assuming this elevated level of risk.

II. Q3 2025 Results: A Severe but Anticipated Stress Test in a Challenging Context

The third-quarter 2025 results for Banco do Brasil served as a severe stress test that largely confirmed the high-risk, cyclical nature of the original thesis. However, the deterioration proved more intense than initially modeled, particularly in agribusiness, leading to sharper profit declines and a more conservative outlook. The stock price has since retreated from earlier highs, reflecting these pressures, but the core long-term case – as a leveraged play on Brazil’s recovery – remains intact for patient income investors.

Source: Yahoo Finance

A. The Foreseen Risks Materialize More Intensely Than Expected

1. Agricultural Concentration: The Downcycle Hits Hard

The quarter highlighted the vulnerabilities of the bank’s heavy reliance on agribusiness (still 52% of the loan book). Commodity price weakness, weather issues, and high input costs severely impacted farmer repayment ability – exactly as anticipated, but with greater severity. Agricultural NPLs (90+ days) surged to 5.34%, up from 3.49% in Q2 and a dramatic rise from 1.97% a year earlier, triggering massive provisions.

2. Credit Risk Dominates

Profitability Q3 underscored how provisions can overwhelm operational resilience. While net interest income grew modestly and fees remained stable (R$8.9B), expenses were controlled – these positives were entirely offset by exploding loan loss provisions. Adjusted net income collapsed ~60% year-over-year to ~R$3.8 billion, with ROE dropping to 8.4% (from over 20% previously). This validated the thesis that credit cycles, especially in agro, drive earnings volatility far more than competition or margins.

Source: Q3 Banco do Brasil Results

B. The Updated Investment Calculus: Lower Price, Persistent Risks, but Attractive Yield

1. Extended Recovery Timeline

Management lowered 2025 guidance significantly (adjusted net income now R$18–21 billion, targeting ~R$20 billion), with the agribusiness delinquency peak potentially extending into 2026. Renegotiations (supported by government measures) are underway, but normalization is a 2026+ story. Visibility remains limited.

Source: Q3 Banco do Brasil Results

2. Dividend Sustainability and Adjusted Payout

The bank reduced its 2025 payout ratio to 30% (from the prior 40-45% range) to preserve capital amid high provisions and regulatory needs. This introduces more variability to shareholder returns, reinforcing the cyclical income profile. However, the forward dividend yield remains compelling – around ~5-7% for the ADR BDORY in USD, impacted by currency) – still well above peers, supported by the bank’s dominant position.

3. Prudent Defense in a Tough Environment

The modest contraction in the loan book reflects disciplined risk management rather than weakness. Digital investments continue, but credit resolution remains the priority. Capital ratios provide a buffer, though near-term ROE pressure persists.

Investment takeaway: The Thesis Endures, with Renewed Margin of Safety at Current Levels

In conclusion, Banco do Brasil remains for me a high-yield, high-risk play deeply tied to Brazil’s structural strengths – its dominant agribusiness and domestic growth – through a historic and resilient institution.2025 has severely tested the thesis: cyclical risks in agriculture materialized intensely (agribusiness NPL at 5.34% in Q3, massive provisions, adjusted profit down 60% y/y to R$3.8B), forcing a reduced payout to 30% and more cautious guidance (R$18-21B net income for 2025). The yield stays attractive in USD for the ADR (about 5%).*

My long-term conviction hasn’t changed: short-term pain was certain, and I accept it as part of this emerging-market cyclical income style.

With my small position in BDORY, I continue to hold, focused on the potential agricultural rebound in 2026+ and the bank’s ability to navigate this downcycle. This is simply my personal thesis as a patient investor – nothing more.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, or legal advice. The views expressed are personal opinions and should not be taken as specific recommendations. Investing involves risks, including the potential loss of capital. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. The author is not responsible for any financial losses or decisions based on the content of this article.

Investment takeaway: The Thesis Endures, with Renewed Margin of Safety at Current Levels

In conclusion, Banco do Brasil remains for me a high-yield, high-risk play deeply tied to Brazil’s structural strengths – its dominant agribusiness and domestic growth – through a historic and resilient institution.2025 has severely tested the thesis: cyclical risks in agriculture materialized intensely (agribusiness NPL at 5.34% in Q3, massive provisions, adjusted profit down 60% y/y to R$3.8B), forcing a reduced payout to 30% and more cautious guidance (R$18-21B net income for 2025). The yield stays attractive in USD for the ADR (about 5%).*

My long-term conviction hasn’t changed: short-term pain was certain, and I accept it as part of this emerging-market cyclical income style.

With my small position in BDORY, I continue to hold, focused on the potential agricultural rebound in 2026+ and the bank’s ability to navigate this downcycle. This is simply my personal thesis as a patient investor – nothing more.

Liked this Deep-Dive? Buy Me a Coffee!

Your support keeps this newsletter independent and research-driven. If this analysis saved you time or gave you a new investment idea, consider making a one-time donation. Every contribution helps me maintain part of the research free and accessible to everyone.

Strong analysis of how operational metrics like agribusiness NPLs (5.34%) can overwhelm even a dominant institution’s earnings. TCLM explores comparable B2B credit and liquidity challenges, offering practical frameworks for managing customer default risk and preserving cash flow through cycles. Could be a complementary resource.

(It’s free)- https://tradecredit.substack.com/